ChasingMe's blog

A common development task is reading data from files. A common file format is the .csv format.

While you can read CSV files using the fs module that comes with Node and get the content of the file, in most cases, parsing and further conversion is much easier with the help of modules made exactly for that purpose.

Multiple modules provide such capabilities like the neat-csv or csv-parser packages. However, in this article, we'll be using node-csv - a suite of CSV packages for generating, parsing, transforming and stringifying CSV data.

Installing node-csvThe module consists of csv-generate, csv-parse, csv-transform and csv-stringify packages.

You can either install the whole suite or each package one by one if you don't need them all. Let's initialize a Node project with default settings:

$ npm init -yThen, let's install the entire node-csv suite:

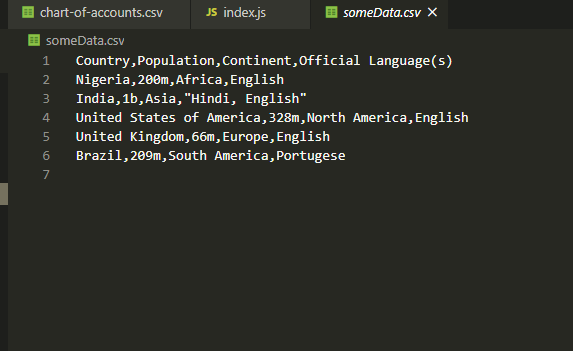

$ npm install node-csvWe'll be working with a CSV file with these contents:

Account Name,Account Code,Type,Description Cash,101,Assets,Checking account balance Wages Payable,220,Liabilities,Amount owed to employes for hours not yet paid Rent expense,560,Expenses,Cost of occupied rented facilities during accounting period Reading CSV Files with csv-parseTo read CSV files, we’ll be using the csv-parse package from node-csv.

The csv-parse package provides multiple approaches for parsing CSV files - using callbacks, a stream + callback as well as the Sync and Async API. We'll be covering the stream + callback API and the Sync API.

Stream + Callback APILet's create a file, called index.js and construct a parser:

var fs = require('fs'); var parse = require('csv-parse'); var parser = parse({columns: true}, function (err, records) { console.log(records); }); fs.createReadStream(__dirname+'/chart-of-accounts.csv').pipe(parser);First, we import the native file system module (fs) and the csv-parse module. Then, we create a parser which accepts an object literal, containing the options we'd like to set. The second argument is the callback function that's used to access the records - or just print them out, in our case.

The options we can set aren't mandatory. In most cases, you'll be using any of the delimiter, cast or columns options:

The delimiter option defaults to a comma ,. If the data from the file you’re trying to parse uses some other delimiter like a semi-colon ;, or a pipe |, you can specify that with this option.

The cast option defaults to false and is used to indicate whether you want to cast the strings to their native data types. For example, a column that is made up of date fields can be cast into a Date.

The columns option is to indicate whether you want to generate the record in the form of object literals. By default, this column is set to false and records are generated by the parser in the form of arrays. If set to true, the parser will infer the column name from the first line.

Finally, we've opened up a read stream using the fs module and started piping it into the parser.

Let's run this file:

$ node index.jsThis results in:

[ { 'Account Name': 'Cash', 'Account Code': '101', Type: 'Assets', Description: 'Checking account balance' }, { 'Account Name': 'Wages Payable', 'Account Code': '220', Type: 'Liabilities', Description: 'Amount owed to employes for hours not yet paid' }, { 'Account Name': 'Rent expense', 'Account Code': '560', Type: 'Expenses', Description: 'Cost of occupied rented facilities during accounting period' } ]Instead of just printing the contents out, you can manipulate this data, construct objects with the information from these fields or save them into a database, for example.

Using Sync APILet's replicate this functionality using the Sync API:

var fs = require('fs').promises; var parse = require('csv-parse/lib/sync'); (async function () { const fileContent = await fs.readFile(__dirname+'/chart-of-accounts.csv'); const records = parse(fileContent, {columns: true}); console.log(records) })();Again, we're importing the fs module and the Sync API from the csv-parse module.

Then, we're creating an async function, in which we retrieve the contents of the file by awaiting the response of the readFile() function.

Then, we can create a parser which takes in the file contents as the first argument and an object literal as the second. This object literal contains options for creating the parser (we've set columns to true). This parser is assigned to a constant variable and we simply print its contents out for brevity's sake:

[ { 'Account Name': 'Cash', 'Account Code': '101', Type: 'Assets', Description: 'Checking account balance' }, { 'Account Name': 'Wages Payable', 'Account Code': '220', Type: 'Liabilities', Description: 'Amount owed to employes for hours not yet paid' }, { 'Account Name': 'Rent expense', 'Account Code': '560', Type: 'Expenses', Description: 'Cost of occupied rented facilities during accounting period' } ] Writing CSV Files using CSV StringifySimilar to reading, we'd sometimes like to write data down into a CSV format. For this, we'll use the csv-stringify package from the node-csv suite. Stringification just means that we'll convert some data (JSON in our example) into a string. This string is then written to a file, in CSV format.

Let's assume you've got some JSON contents that you'd like to write down as a CSV file:

var someData = [ { "Country": "Nigeria", "Population": "200m", "Continent": "Africa", "Official Language(s)": "English" }, { "Country": "India", "Population": "1b", "Continent": "Asia", "Official Language(s)": "Hindi, English" }, { "Country": "United States of America", "Population": "328m", "Continent": "North America", "Official Language": "English" }, { "Country": "United Kingdom", "Population": "66m", "Continent": "Europe", "Official Language": "English" }, { "Country": "Brazil", "Population": "209m", "Continent": "South America", "Official Language": "Portugese" } ]The csv-stringify package also has a couple of API options, though, the Callback API offers a really simple way to stringify data, without the need to handle events like with the Stream API.

Let's go ahead and stringify the data above, before writing it to a file:

var fs = require('fs'); var stringify = require('csv-stringify'); stringify(someData, { header: true }, function (err, output) { fs.writeFile(__dirname+'/someData.csv', output); })Here, we're importing the fs and csv-stringify modules. Then, using the stringify() function, we supply the data we'd like to convert to a string. We've also supplied an object literal containing the header option. Finally, there's also a callback function that's used to write the contents down into a file.

Other options like cast, columns and delimiter are also available. In our case, we’re setting the header option to true to tell the stringifier to generate the column names in the first record.

Running this code generates a file with the proper contents:

The node-csv module is a suite of smaller modules used to read/parse, transform and write CSV data from and to files.

We've used the csv-parse module to read CSV files and the csv-stringify module to stringify data before writing it to a file using Node.js.

https://stackabuse.com/reading-and-writing-csv-files-in-nodejs-with-node-csv/

The difference between webpage and website is unanimously erred in terms of their functionalities, and often when anyone reads these two terms starting with “Web.”

Both these terms “Webpage” & “Website” reflect each other in many ways, and most of the time, they are used interchangeably. However, that’s the reason these two terms are frequently misunderstood and plunged into the confusing modern English literature.

If you’re new to the web world, or maybe not, you might be taking this common phrasing illusion many times in your work life. These two terms do reflect each other but are distinct. And moving ahead, we’ll clear the confusion.

The Misconception!

A webpage is a document that can be viewed on any browser such as Firefox, Chrome, and Safari, and it is a single page that provides all the related information. On the other hand, a website is a combination of several webpages interlinked to each other, working collectively as a website.

Okay, that’s the basic difference!

But this is the misconception people develop that both are the same. Generally, everyone assumes that they both have the same ultimate aim to display the information, and also they work in the same manner.

Nevertheless, it is not the same. This is what we are going to clear with you all – the difference between webpage and website.

Difference between Webpage and Website DefinitionWebpage

A web page can be described as a single homepage. In order to access a web page, a user can launch it with a URL, which can also be copied and shared with others. In comparison to the website, accessing a webpage needs no navigation. They can include text, images, audio, video, hyperlinks to other pages. Web browsers are used to access the webpage content by linking to a website to view remote files. These are created using HTML, PHP, Python, and Perl programming language. The HTML pages are basic, not interactive, but take less time to load and search.

Website

A website is usually listed under the generic domain name containing the collection of webpages. Normally, the homepage of a website is more specifically referred to as a “website.” For example, a company’s website could be connected to different web pages, including home, about us, products, services, and other information. It can be accessed via a web address. Users can use static websites or dynamic web pages to create clients’ websites. The website contents are also viewed globally, and it always remains constant wherever a user is located.

Common UsesWebpage

- In sales and marketing, webpages are often used as landing pages or lead capture pages to target and capture the customers’ information.

- Webpages are also helpful in the form of the sales letter to convince the buyers through persuasive techniques.

- One of the digital use of webpages can be as a portfolio. Architects, designers, digital marketers, and other professionals can use a single webpage as their portfolio to attract new customers.

- Another exotic use of a webpage is in the form of an interactive digital resume. This type of resume lets recruiters associate with the applicants’ skills and fundamentals areas on a webpage.

- Webpages are more user-friendly in terms of interaction with users and lead to a better understanding of customers.

Website

- Websites embrace broader fields than a webpage, for example, a company’s website has different webpages such as product, contact, services, and various others. A website helps navigate consumers into a deeper understanding of what the company deals with.

- Several online gaming websites allow users to play online games for free or maybe with a fee. Besides, in the same way, there are various services websites available in the market.

- Nowadays, we’re more focused on apps; however, web-based versions of various social media sites are still popular, and people love to use them on their laptops and PCs.

- Blogs (Travel, News, Technical, Educational, Govt, etc.) are extremely helpful for people when planning to learn something new.

- Other uses of websites include information sharing, online grocery, spreading awareness, NGOs and non-profit organizations, consultancy, and many others.

A website includes all the contents of the individual files put online and published. The web page is part of a platform that runs and manages a website.

There are many points to include in the difference between webpage and Website, but the distinction is in scope at a more realistic stage. A web page focuses on an extraordinarily specific topic, like a letter of sale or a description. Websites offer more broad-based information or services.

If you find this article useful or feel like anything is to be included, please let us know in the comment box below.

The post Difference between Webpage and Website appeared first on The Crazy Programmer.

https://www.thecrazyprogrammer.com/2020/09/difference-between-webpage-and-website.html

Fear of Rejection Paralyzing You? Then Watch This (Matthew Hussey).....

—

Barry Price teaches women about empowerment in relationships. He is a Relationship Expert, trained by renowned psychotherapist Esther Perel. He started at eight-years-old by helping his single mom through her relationship ups-and-downs. He brings empathy and a male perspective as he teaches women how to be empowered in relationships, Barry has helped thousands of powerful women create healthy, empowered relationships.

In this episode of Last First Date Radio:

– Why it’s challenging for powerful women to find love

– The difference between powerful and empowerment

– The type of man an empowered woman seeks

– The keys to strong, successful women finding love

Empowerment Is The Path to A Healthy Relationship How did you get started as a relationship coach?I loved my mom and wanted to see her happy. My parents divorced when I was four. My mom was powerful and vivacious, but she had some unhealed stuff when it came to men. I watched her go through the roller coaster of dating, and I wanted to help.

When I began coaching, I was marketing to guys, but I had more powerful women who were interested in my support. I can make the greatest impact on women. I get what they’re going through. I care so much about empowerment, helping women get the partner they deserve.

What does empowerment have to do with dating and relationships?The more a woman can be empowered, the better her relationships will be. I help her ask herself powerful questions to step more fully into her authentic self; “Who have I been in my past relationships?” “Who do I need to be?” “Who am I when I’m not putting a wall up?” After we take care of the internal, we can focus on the external.

What’s the difference between a powerful woman and an empowered woman?Empowerment and power can be very misconstrued. We have different sides to our energy. If the feminine role model in a family is dis-empowered, it can lead us to believe that being in masculine energy is empowered. Feminine energy can feel weak. There’s nothing more powerful than an empowered feminine. It’s having both energies balanced. Know when to call upon each energy. True empowerment is complete self acceptance. Powerful women can struggle with the feminine side.

Why do powerful women attract boys but empowered women attract men?If you’re massively in your masculine energy, you’ll attract men who are in their feminine energy. To change that, Go to Stop Being His Mommy, Date Men Not Boys. Email Barry at barry@healthyempoweredrelationships.com to get your copy.

What are the 5 M’s to tell the difference between men and boys?- Maturity. Emotional literacy, talks and processes through his feelings. Socially mature.

- Mission. Defined sense of purpose. His work is meaningful to him.

- Masculine. Healthy versions of the masculine. Takes on challenges.

- Myself. Knows himself and his boundaries.

- Makes you feel safe. Depends on what safety represents to you. Financially, emotionally, etc.

Listen to Barry’s podcast, HER:Healthy Empowered Relationships podcast.

Go to datemennotboys.com/freegift for a free audio file on the 3 Keys to having a healthy relationship.

Please subscribe/rate and review the podcast here.

If you’re feeling stuck in dating and relationships and would like to find love this year, sign up for a complimentary 1/2 hour breakthrough session with Sandy https://lastfirstdate.com/breakthrough

Join Your Last First Date on Facebook https://facebook.com/groups/yourlastfirstdate

Get a copy of Sandy’s new book, Becoming a Woman of Value; How to Thrive in Life and Love here.

https://lastfirstdate.com/empowerment-is-the-path-to-a-healthy-relationship/

Introduction

In this tutorial, we'll be converting a Java Array into a Java Stream for primitive types, as well as objects. This can be done either via Arrays.stream(), as well as Stream.of().

Arrays.stream()

A good way to turn an array into a stream is to use the Arrays class' stream() method. This works the same for both primitive types and objects.

Primitive Types

For primitive types, you can use Arrays.stream() with an array reference as the parameter.

Optionally, you can also specify the range of indices that should be used as the starting and ending point of the stream/array. If these are not supplied, the entire array will be converted:

// Entire array is used for constructing the Stream

Arrays.stream(T[] arr)

// Construct Stream with a range of elements

Arrays.stream(T[] arr,int start_ind_Include,int end_ind_Exclude)

)

Let's instantiate an array and convert it into a stream:

long[] array = {2, 5, 9, 10, 15, 18, 56};

LongStream stream = Arrays.stream(array);

System.out.println("Long stream:");

stream.forEach(x -> System.out.print(x + " "));

This results in:

Long stream:

2 5 9 10 15 18 56

Similarly, we can create a stream from a range of indices (0,4) by supplying them as the parameters. Note the starting index of the range is included and end index is not included when a range is specified:

LongStream stream = Arrays.stream(array,0,4);

System.out.println("\nLong stream from index 0 to 3:");

stream.forEach(x -> System.out.print(x + " "));

This results in:

Long stream from index 0 to 3:

2 5 9 10

Objects

For objects, Arrays.stream() returns a Stream of the specified object. It accepts an array reference and optionally takes in a range of indices. Let's make a String array and convert it into a Stream:

String[] array = new String[]{"John", "Jenny", "Martha", "Adam"};

// Create a Stream

Stream<String> stream = Arrays.stream(array);

System.out.println("Entire array:");

stream.forEach(c -> System.out.println(c));

// Create a Stream from a range

System.out.println("\nSubarray:")

Stream<String> streamWithRange = Arrays.stream(array,0,2);

The above code generates the following output:

Entire array:

John

Jenny

Martha

Adam

Subarray:

John

Jenny

Stream.of()

Primitive Objects

Instead of using the Arrays class, we can also use the goal class - Stream. The of() method, as the name implies, creates a Stream with a given collection, such as an array.

Keep in mind, Stream.of() returns a stream of objects, regardless of the type you're using. You'll have to flatten it for primitive types. The conversion/casting is done automatically for objects, since in that case, the Stream.of() method just calls Arrays.stream().

Let's make a primitive int array:

int[] array = {1, 2, 3, 4, 5, 6, 7, 8, 9};

Stream<int[]> stream = Stream.of(array);

System.out.println("\nInt stream: ");

// Need to be flattened to its primitive type

stream.flatMapToInt(Arrays::stream).forEach(x -> System.out.print(x + " "));

The flattening is done via the Arrays.stream() method, which in this case just adds redundancy to the code. Instead of using Stream.of() on primitive arrays, we can use built-in classes for these such as IntStream.

This code results in:

Int stream:

1 2 3 4 5 6 7 8 9

Objects

Now, let's create a Stream of String type. We'll then filter out only names that start with the letter 'J':

String[] array = new String[]{"John", "Jenny", "Martha", "Adam"};

Stream<String> stream = Stream.of(array);

System.out.println("Printing only names that start with 'J'...");

stream.filter(string -> string.startsWith("J"))

.forEach(System.out.pritnln(string));

The code has the following output:

Printing only names that start with 'J'...

John

Jenny

Conclusion

In this article, we've covered the two ways you can create a Stream from an array. This goes for both primitive arrays and object arrays.

The Arrays.stream() method is a straightforward one, which accepts an array reference and an optional range. The Stream.of() method calls Arrays.stream() for object types, while it requires flattening for primitive types.

https://stackabuse.com/java-convert-array-to-stream/

Penetration testing (or pentesting) is one of the most effective means of unearthing weaknesses and flaws in your IT infrastructure. It exposes gaps so you can plug them before a malicious party takes advantage. Whereas the benefits of pentesting are clear, a pentest is only as effective as its planning and execution.

Substandard pentesting will not only yield results that add no value but could also endanger the very infrastructure it’s meant to help protect. Before you run a pentest or commission a third party like Emagined Securityto do it for you, beware of the most common mistakes testers and businesses make. Here’s a look at some of these.

5 Common Pentesting Mistakes

A pentester must put themselves in the shoes of a real hacker if they are to model and run scenarios that mirror the real world. But that is the only thing that a tester should have in common with a cybercriminal. Importantly, the pentester should leverage their technical ability to improve security while subscribing to the highest level of ethics.

During the test process, the pentester will likely gain access to sensitive corporate information. They’ll also become aware of the potential loopholes an attacker could use to break through the organization’s defenses. It would be a grave error if they were to disclose or utilize these privileges outside the boundaries of their authorization.

Testers must hold sacred the great trust the target organization has bestowed on them. They must subscribe to the principles of legality, confidentiality, and privacy at all times.

Unauthorized TestingThe pentester aims to identify gaps in the system. Whereas they are paid to break the rules, this has to be done with pre-authorization and predefined terms of engagement.

Testers can get overly enthusiastic in demonstrating their skills and thus lose focus from their primary objectives. They may crash a critical system by going beyond what they are permitted to do. This can be especially destructive if part or all of the test is conducted in a live production environment.

Rules of engagement must be disseminated to all involved and any aspects that are unclear discussed beforehand. The rules would include scope, systems covered, systems excluded, types of tests, timeframe for testing, and escalation procedures during emergencies.

Not Properly Safeguarding Evidence‘Trust but verify’ is the golden rule of auditing. This could very well be applied to pentesting too. Like all techies, pentesters sometimes perceive the capture, retention, and documentation of evidence as a distraction. If you offer no evidence to back up your test report, it’ll be difficult for decision-makers and other stakeholders to accept and act on your claims.

From the start, determine what evidence you need to capture. At the minimum, this would include the exploited vulnerability, timestamp of the exploit, unauthorized actions you could perform, number of unsuccessful attempts, and any breach detection that occurred. This evidence is the foundation of a fact-based pentest report.

Over-Reliance on ToolsEnterprise IT infrastructure is highly complex. It’s virtually impossible to run a substantial pentest today without some reliance on automated tools – from applications like Wireshark that quickly scan targets and traffic, to solutions such as Metasploit that streamline the development of custom exploits.

The range of tools at a pentester’s disposal is vast. So much so that one would be tempted to sit back and let these solutions do all the work. But tools are only as useful as the skill level of the person who wields them. Tools should never lead a pentesting program. Instead, they should implement the concepts, ideas, and plans the tester has already thought through.

Failure to Recognize the System is Indeed SecureThe focus of a pentest is not to achieve intrusion by all means. Instead, it’s to assess how protected the infrastructure is from the methods cybercriminals would use.

Ergo, if you run an exhaustive test that doesn’t result in successful intrusion, that shouldn’t worry you. It’s ok for the test findings to conclude that the system is secure. Many rookie pentesters lose sight of the greater goal and go all out to prove some gap exists.

The road to becoming a top-notch pentester is years-long. Achieving expertise is contingent on minimizing the number of mistakes you make. Recognizing these pentesting mistakes is essential to getting your tests consistently correct.

The post 5 Common Pentesting Mistakes appeared first on The Crazy Programmer.

https://www.thecrazyprogrammer.com/2020/09/common-pentesting-mistakes.html

A special message

from Bill Bonner

San Martín, Argentina

April 2020

Dear Reader,

We are facing an unprecedented challenge.

** A lethal virus has struck the world… One Federal Reserve governor warns that US GDP could be cut in half – worse than the Great Depression. But there’s a deeper story here… one that needs to be told. Why are Treasury bonds suddenly going down… when they should be going up? Why is cash suddenly becoming so scarce when the Fed is supplying hundreds of billions of dollars every week?

** Stocks are down 30%… with wild price gyrations… is the bottom in? Is there more damage to come?

** Corporate bonds – some $16 trillion worth – face a meltdown… Will some of the biggest businesses in America be forced to default? Is a “Lehman moment” coming soon?

** Governments have begun inflating (printing new money) on a scale never before seen. What will that mean? Will consumer prices soon “take off”?

Just take a look at this chart. Do you see what I see?

That line on the right is not the right axis. It’s a jolt of chaos…this is a market in crisis.

The Fed adds money. And still prices go down. It is the most dangerous… and potentially profitable… market we’ve ever seen.

Nothing like this has come along before. Most likely nothing will again as long as we live.

No one can seem to agree on where it’s headed… so recently I set out to get some solid answers.

And to bring you those answers, I’ve brought together some of the best minds I can find…

These are men who predicted exactly the situation we are now in…

…who understand how it all works…

…and who are now showing their readers how to make (or preserve) money, rather than lose it, in the midst of what could become the worst crisis in American capitalism in history.

Just look at this chart. It shows – beyond doubt – that it is possible to make money even in the most savage sell-off America has ever seen:

That’s the kind of investment we want to own!

I’ll introduce our experts in a moment. But let me first describe the point of this exercise.

I brought together these experts to prepare a Situation Report… similar to the intelligence briefing the president of the US receives every day.

And I believe these dossiers are the most important we’ve ever issued.

Don’t be fooled by

market upswings

First, I need to warn you. As the old-timers say on Wall Street, “Mr. Market is a Trickster.” He draws as many people as possible into his trap. And then it springs shut.

Then, to make sure he captures as much “dumb money” as possible, he pretends to back off… so stock prices rise. People say, “Buy the dip”… “The worst is over”… ”It’s back to normal.”

Then, he attacks again.

That’s the way it went in 1929-1932… in 2000-2002… and in 2008-2009. After the ’29 Crash, for example, the bottom didn’t come until three years later.

You can see that in this chart:

The lesson? Here’s how the old-timers put it:

Never try to catch a falling knife.

And here’s something else that is very important:

This is not a repeat

of 2000… or 2008.

Both of those were financial crises. Money got tight. Credit got scarce. So the government simply flooded our country with more money and cheaper credit.

This time, it’s different.

By the time this started, the government was already lending money at less than zero… and flooding the economy with vast sums of new money. Yet, that didn’t stop the biggest sell-off in history…

All over the world, businesses have stopped doing business. Consumers have stopped consuming. Wage earners have stopped earning wages. And taxpayers have stopped paying taxes.

The government can say they are delaying the tax deadline… but it’s not out of the kindness of their hearts… it’s because they don’t want to stoke mass panic when everyone realizes there’s no money left to pay those taxes with.

What we’re looking at is far more serious than the crisis of ’08-’09.

That’s what our small panel of experts spell out in these reports I want to send you: the what… why… how… and when of the present crisis. What’s going on… and what it means.

They’re going to tell you – specifically – what’s happening and what you need to do about it… right now.

Let me tell you about

this unique group

I can’t reveal their names. People pay thousands of dollars for their advice and financial management; they don’t want to appear to be giving it away for free.

The first thing to understand is that they come from very different places. One is an Australian… carefully watching the boom, boom, booming Australian market for years… but with a sharp eye on New York and Washington too…

His book, A Parent’s Gift of Knowledge, which is all about the passing of investing intelligence from father to daughter, is what caught my eye some 10 years ago.

Is now the time to refinance your home? How much cash do you need to “tide you over” through this rough patch? He has the answers… after a lifetime of study.

Another member of our team is based in London. He’s one of the sharpest macro-investment thinkers I’ve ever met.

Until recently, he was director of investment for a wealth management company which looked after £1.5 billion of clients’ money.

He’s one of us. When the 2008 crisis struck, the London stock market got cut in half. I was there at the time. I saw investors ready to slit their wrists. But not his clients; they were among the few to survive with their wealth intact…

One other member of the group deserves a special introduction. His grandfather was president of Barclays, one of the world’s biggest banks at the time. His father followed the banking tradition. And so did he… analyzing risk for Citigroup in London… where his traders were handling trillions of dollars’ worth of positions.

You might say “finance” is in his blood.

But in 2018, he made an important move. When the Fed stopped “normalizing” its finances, he saw the writing on the wall and moved 100% of his money to gold.

Bold? Definitely. Crazy? A lot of people thought so at the time. But it doesn’t look so crazy now. In fact, it looks inspired.

Here’s what he avoided:

Since the S&P 500 peaked on 2/19/2020…

- Norwegian Cruise Line is down 69%

- Royal Caribbean International is down 63%

- Carnival Cruise Line is down 59%

- MGM Resorts is down 58%

- Marathon Petroleum is down 59%

- Las Vegas Sands is down 30%

- Boeing is down 46%

- United Airlines is down 55%

- Citigroup is down 41%

- Hilton Worldwide is down 35%

- ExxonMobil is down 36%

- Ford is down 35%

- Starbucks is down 22%

- Best Buy is down 31%

- Disney is down 25%

- Goldman Sachs is down 30%

- JPMorgan Chase is down 29%

- Union Pacific is down 22%

- McDonald’s is down 22%

He spared himself all those losses… and slept like a baby! Not only that, he took his family on an 18-month round-the-world odyssey… as if he hadn’t a care in the world.

And now his next move is a bombshell…

He’s protected himself from the big sell-off (more to come… he says) and gotten richer in the market meltdown…

He’s protected his family in a completely original version of social distancing… (I’ll let him tell you about that himself in his report…)

And now he’s finding ways to make big profits by anticipating the Fed’s next moves.

“This phase won’t last forever,” he says. “And now people are panicking. There are investments available now – in mining, oil, and transportation – that we never would have dreamed of a few months ago.”

Getting in Front of the Fed

There is big money to be made by knowing what the Fed’s response will be. In all modesty, our team has that nailed. Cold.

Nothing in the Fed’s response so far has surprised any of us. Every member of the team saw it coming. That’s why I selected them for this project.

And we can guarantee that the government bailouts will benefit some industries… and some investments… and some people — hugely.

On the other hand, there are some things – corporate bonds! – that are going to be wiped out. Erased from the face of the Earth.

The point is, there is big money to be made by simply putting your investments on the right side of the biggest financial event in history – the attempted bailout of the entire US economy.

The big money, over the last three decades, has been made by anticipating the actions of the Fed. That is, the serious players figured out that the Fed had to support the bond market by lowering interest rates and buying bonds. So, they bought them first and made billions in profits.

Now is an opportunity for you to get in front of the Fed too. We know what the Fed MUST do. And it will mean a huge turnaround. If you’re on the wrong side of this flip-flop, you’re going to lose and lose big.

But you don’t have to be. Instead, this is one time when ordinary investors and even homeowners can play the Fed, too.

Once-in-a-Lifetime Bargains

There is also a lot of money to be made by “bottom fishing.” That is, there are some very weak companies that have destroyed their own balance sheets because of too much borrowing… too many share buybacks… too many bad acquisitions financed by cheap money. Boeing. GE. Occidental Petroleum. Big hotel chains. Airlines…

Some of these companies are NEVER coming back. Never. They dug their own graves during the boom years. Stay away.

But there are other companies that made the right decisions… carefully holding onto their profits… and investing wisely to build their businesses. They’re not going away. They’re not going broke. They’re just hunkering down until the storm blows over.

Want to know how to find these firms? Just run these “screens.”

- Market cap greater than $150 million (just to strain out the micro-caps)

- Price-to-earnings ratio greater than 1 (gets rid of the companies losing money)

- Price-to-tangible book ratio less than 1

- Debt-to-equity not to exceed 0.30 (gets rid of heavily indebted companies)

These will be the best stocks to buy… especially when this deflationary phase bottoms out.

They’ll be selling for a fraction of what they cost a few months ago. Because a bear market takes down ALL stocks… not just the bad ones. Just as most investors didn’t know what to buy during the boom… they don’t know what to sell during the bust. Read full article here

Now, according to this week’s guest editor, Nick Giambruno, the Fed has another trick up its sleeve – negative interest rates. Essentially, this is a government-imposed tax on your savings. Putting your money into something with a negative interest rate guarantees you will lose some of it.

So why would anyone do such a thing? And more importantly, how can you avoid it?

Below, Nick outlines two ways you can sidestep negative interest rates… and government interference in your finances.

The Government Never Lets a Crisis Go to WasteBy Nick Giambruno, Chief Analyst, The Casey Report

“You never want a serious crisis to go to waste. And what I mean by that is an opportunity to do things that you think you could not do before.”

These are the words of Rahm Emanuel – the former mayor of Chicago and President Obama’s Chief of Staff.

Exploiting crises has long been the modus operandi and ethos of the many sociopaths that fill governments.

For example, the crisis of the Great Depression in the 1930s allowed the government to confiscate the gold of private citizens and implement The New Deal. These actions drastically increased the size and scope of the federal government far beyond its constitutional constraints.

The government used the alleged crisis of the War on (some) Drugs to create the DEA (Drug Enforcement Administration) and push all sorts of authoritarian actions that curtailed personal and financial liberties.

The 9/11 attacks allowed the government to pass the so-called Patriot Act – which was likely written before 9/11 – and create the Department of Homeland Security, an entirely new permanent bureaucracy.

These are just a couple of examples of the government using a crisis to implement things it usually couldn’t.

Governments always have a set of radical programs they could never pass under normal circumstances sitting on the shelf, waiting for the right moment. As Rahm Emanuel infamously stated, crises offer the perfect opportunity.

I’m bringing this up because today, the U.S. is facing a global pandemic and the biggest economic crisis since the Great Depression.

And you can bet the government’s not going to let it go to waste.

While there is a whole slew of troubling proposals on the table or already being implemented – immunity passports, moves to eliminate cash, unconstitutional “stay at home” orders, increased cell phone tracking and surveillance – I’d like to focus your attention on one in particular: negative interest rates.

Recommended LinkLook who’s getting banned in America. Will you be next?

According to MarketWatch, ordinary Americans are being put on ‘restriction lists’, being banned from using certain businesses.

Why is this happening? And what does it mean for you?

Widely-followed geopolitical expert Nick Giambruno explains:

“This is just the beginning of a much larger movement I’ve been watching unfold for years in the United States.

Law-abiding Americans will soon have a critical decision to make.”

Will you be banned next?

Go here to find out--The Federal Reserve’s Next ScamNegative interest rates are the next scam the Federal Reserve will perpetrate as the supposed cure for the economic crisis.

The government and mainstream media are sure to cheer and promote this economic poison. I will show you what negative interest rates really are – so you won’t be bamboozled.

Bill Gates, the Military, and Google Are All Involved…

Certain banks – especially in Europe – are already charging their depositors negative interest rates, which penalize them for saving. (You can try to escape this by holding physical cash, which is why governments around the world are waging a totalitarian war on cash. But even that isn’t enough. You need something that retains value for the long haul.)

Putting your money into something with a negative interest rate guarantees you will lose money. So why would anyone ever do such a thing?

You don’t need to be a financial expert to see that negative interest rates don’t make any sense at all – they’re a swindle.

Interest is not a complex topic that the average person can’t wrap their mind around.

Negative Interest Rates = Tax on Savings“Negative interest rates” is a euphemism. It’s like calling an armed burglar a “surprise house guest.”

Instead, let’s be clear and descriptive about what is happening.

It’s a government-imposed tax on savings.

Keep that in mind the next time you hear the government or their lackeys in the media and academia discuss negative interest rates. It will help you think clearer.

Negative interest rates are coming to the U.S.

But it’s not all unwelcome news.

In fact, those who know what to do before they hit will dodge this swindle… and even supercharge their wealth – if they take the right steps.

Recommended LinkHe’s Done It – This Is Bigger Than 5G

5G. AI. Self-driving cars. Everywhere, you’ve heard at least one of these called “the biggest tech market investing story of the next five years.”

Not so fast, says the man who’s been called “America’s top technology profit” and an “American genius” by international media.

Something else is coming on the tech horizon. Something potentially bigger than all those breakthroughs. With a potential $16.8 trillion impact worldwide.

Follow this link for full details--Two Ways to Skirt the Government’s PenaltyFor over 5,000 years, gold has been mankind’s most enduring form of wealth.

Throughout history, many different civilizations around the world have all come to the same conclusion: Gold is money.

That didn’t happen by accident.

It happened because gold has a set of characteristics that make it uniquely suitable as money. It is durable, divisible, consistent, convenient, and most important, it has strict scarcity.

But for the last 50 years, governments and their lapdogs in academia and the media have tried to minimize the importance of gold in favor of their inferior paper currencies – which they can, of course, create unlimited quantities of whenever they want.

Many people don’t realize that the market for money is not that different than the market for other goods.

The dollar competes with gold as money. The dynamic is similar to competing products in other areas.

For example, at the grocery store, you have the choice between Dasani and Poland Spring for bottled water. Imagine the quality of Dasani drops rapidly. As a result, people stop buying Dasani and flock to a more desirable substitute in the market – Poland Spring.

The same development is happening in the market for money.

Gold is going to become a more attractive form of money, as governments make its principal competition (paper currencies) even more unappealing.

Urgent: Angel investor says Tesla on verge of billion-dollar deal.

Governments are deliberately destroying their currencies with wrongheaded measures they think will boost the economy – like creating trillions of dollars out of thin air and manipulating interest rates below zero.

Negative interest rates guarantee you’ll lose money. They undermine one of the primary functions of money – being a store of value.

Further, one of the most common idiotic objections to gold you often hear is that “it doesn’t have a yield.”

Of course, gold is not supposed to have a yield – it’s not a dividend-paying corporation or an interest-paying savings account. It’s simply money.

But let’s set that aside and suppose gold should have a yield. With negative interest rates, gold’s 0% yield doesn’t look so bad.

Recommended LinkBonner Chief Technology Analyst Releases Top 3 “Penny IPOs” For 2020

While Wall Street was busy lying to you last year…

Pumping up their “hot” IPOs like Uber and Lyft (down almost 75%!) …

Tech legend Jeff Brown was playing a different game…

Focusing on tiny “Penny IPOs” 100 to 300 times cheaper…

And boy did it pay off!

Jeff recommended a little-known Penny IPO that quickly shot up 432% in 6 weeks…

And, now, he’s spotted 3 more.

But you need to act quick. Because you can buy shares in ALL 3 of these tiny Penny IPOs right nowfor under $50…

TOTAL!

Get the Details on Jeff’s Top 3 Penny IPOs-Gold’s Only PeerLike gold, I expect Bitcoin will be a huge beneficiary of negative interest rates.

Bitcoin shares many of the same attributes that make gold attractive as money. It’s the world’s first scarce digital asset.

Further, it’s durable, divisible, convenient, consistent, and has tremendous value as a transfer mechanism that is outside of anyone’s control.

Bitcoin is the only crypto that is truly not controlled by anyone. Nobody can get together and alter its supply, which is fixed for eternity.

It is for this simple reason that no other cryptocurrency – and no asset other than gold – even comes close to possessing the monetary properties of Bitcoin.

As a free-market, non-government, hard money, Bitcoin is in the same league as gold.

So when gold soars as negative interest rates breach the U.S… I expect Bitcoin will do the same.

These two assets are your ticket to protecting your – and your family’s – wealth from government confiscation… devaluation… or a brazen swindle.

I’ve put together an urgent video to give you more information on how to sidestep the government’s plan to blindside you.

This latest crisis is just another excuse to exploit crisis at the expense of everyday Americans. Make sure you prepare today.

Regards,

Nick Giambruno

Chief Analyst, The Casey Report

Alt tag goes here

Get a design job, guaranteed.

Take your career to the next level. Springboard is offering Premiumcoding readers a $300 scholarship for the first 20 students to enroll with code UX300.

Apply Now

It’s time to turn your eagle eye for design into a career in UX. Fast-paced, remote-friendly, and structured to fit into your schedule. Job guaranteed, or your $$$ back.

Alt tag goes here

Want to start your design career?

Build a unique portfolio of projects that will stand out to employers. Students will complete three portfolio projects, including a capstone project.

Archives

- All

- March 2023

- January 2023

- October 2022

- September 2022

- August 2022

- August 2022

- June 2022

- June 2022

- June 2022

- June 2022

- June 2022

- June 2022

- June 2022

- July 2021

- May 2021

- May 2021

- January 2021

- January 2021

- January 2021

- December 2020

- December 2020

- December 2020

- December 2020

- November 2020

- November 2020

- October 2020

- October 2020

- September 2020

- September 2020

- September 2020

- September 2020

- September 2020

- September 2020

- September 2020

- September 2020

- September 2020

- July 2020

- July 2020

- April 2020

- August 2018

- January 2018

- November 2017

- September 2017

- March 2017

- February 2017

- January 2017

- October 2016

- May 2016

- March 2016

- March 2016

- January 2016

- November 2015

- November 2015

- November 2015

- November 2015

- October 2015

- June 2015